Lirio empowers you to orchestrate each person’s unique and evolving healthcare journey using hyper-personalized communications that support health outcomes.

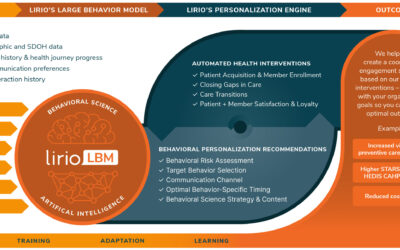

The Lirio platform influences each person’s health actions by leveraging behavioral science expertise and adapting to people’s evolving clinical history and social context.

Powered by the world’s first Large Behavior Model for healthcare, it allows you to automate the ways you engage with your population via dynamic, personalized communications that create individualized healthcare experiences.

We call it Precision Nudging®

And whether it’s helping patients or members enroll, engage, or navigate, Lirio helps you close gaps in care and work to ensure every person’s journey is marked by autonomy, empowerment, and improved outcomes.

One-to-One Personalization

We move past standard demographic segmentation to create highly tailored communications that make individuals feel known.

Sustained Engagement

Our platform continuously learns, and our behavioral interventions adapt in real time to help you motivate patients and members to stay engaged with their health and your organization.

Healthier Populations

Lirio helps you reach more people earlier with the right care solutions so you can guide them on their unique, ongoing health journeys, address health equity issues, and close gaps in care.

Lower Total Cost of Care

We automate many of the ongoing touchpoints with your population so you can maintain engagement at scale while strategically allocating limited resources.

How Lirio Moves People

Discover Lirio

Health Systems

Move patients toward relational engagement that supports improved population outcomes.

Payers

Move members to engage with benefits that lead to better outcomes and lower costs.

The Power of Large Behavior Models in Healthcare Consumer Engagement

AI solutions are on the rise throughout healthcare – and both payers and health systems are aiming...

Promoting Health Equity in Mammography Adherence: Embracing the Dual Lens of Age and Race

During the last two decades, breast cancer rates have been decreasing in the United States (1, 2)....

Lirio Again Named a Top Workplace Based on Feedback from Employees

Lirio, which uses artificial intelligence and behavioral science to hyper-personalize healthcare consumer experiences, has been awarded a Top Workplaces 2023 honor by Knoxville Top Workplaces. The company was recognized for the second time it participated in the program, has also received recognition as a national Best Workplace by Inc. Magazine, and received the Pinnacle Award for Best Mid-Sized Company by the Knoxville Chamber.

Lirio and Truth Initiative Partner on Precision Nudging™ Intervention for Tobacco Cessation

Truth Initiative’s EX Program is partnering with Lirio, a behavioral science tech company, to expand its member marketing capabilities. Through this partnership, they’ll harness the power of AI to drive even greater reach of their tobacco cessation program to employees and members.

How It Works

Want to see our process in action? Learn more about our approach that moves people along their unique journeys to better health.